In California, financial power of attorney comes into effect when you sign the document and become incapable of managing your finances. Still, if you become unable to do so or decide on a durable power of attorney, then your spouse or relatives have to ask the court for authority over at least some of your financial affairs. A power of attorney for finances has to be documented by you. An attorney-in-fact can manage your finances only when you become incapacitated. To use the form to sign any legal agreements on your behalf your appointed Agent will need to add the word “by” to the section where your name is printed and write their name followed by “acting as Attorney-in-Fact”.The financial power of attorney in California is a written instrument in which one person designates another person or agent to act on behalf of the principal. Once the document has been officially signed, it will normally come into force with immediate effect unless you have specified otherwise.īe sure to keep the form in a secure and accessible place as it will need to be presented to validate the transactions being managed by the Agent. In some states, this will require the assistance of a notary and you may need to provide witnesses to the signing. What financial compensation will be made available to the AgentĪny fiduciary duties the Agent must perform for youīoth you and the Agent must sign your signatures and mark the date on the completed document to bring it into effect.

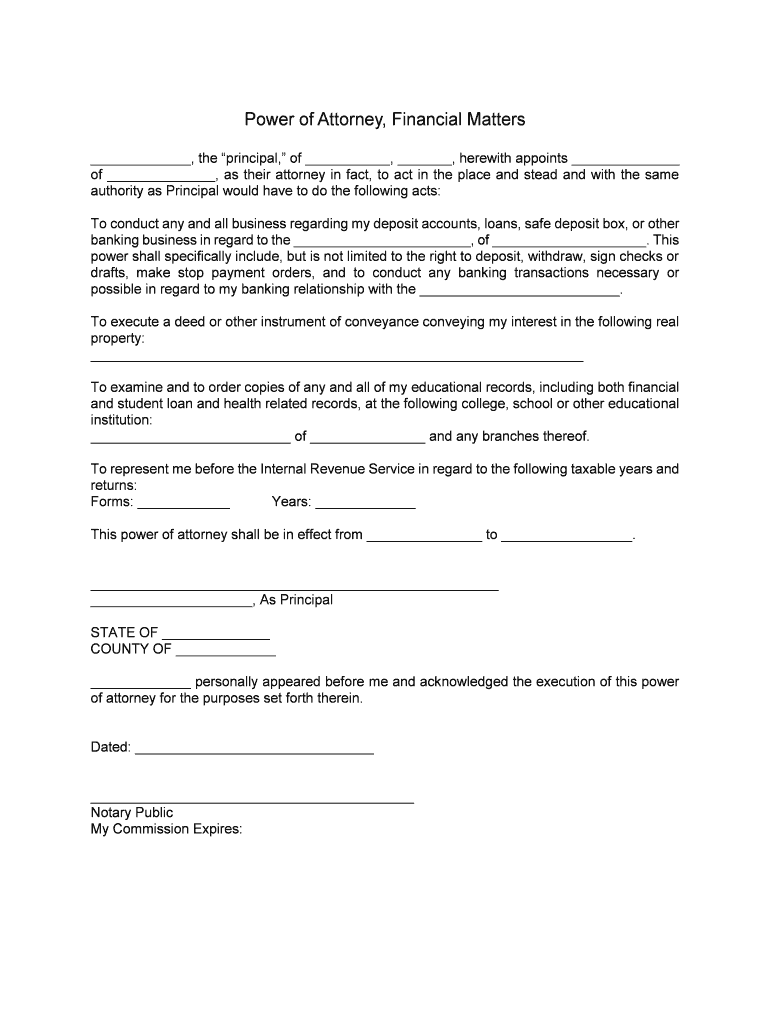

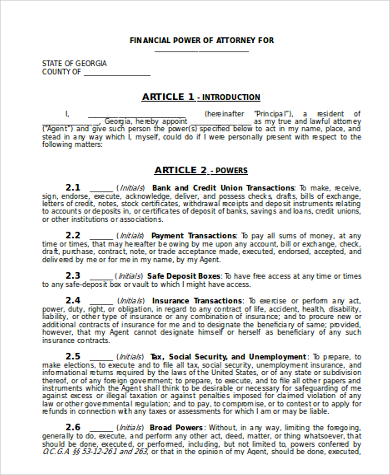

In order to complete the form, you will need to provide key information that will allow the Agent to perform their role effectively. When you’ve chosen a suitable Agent and know what duties you will need them to manage for you, you’re ready to fill in the POA document. However, if your situation is more complex your POA can include powers to manage stocks and shares, government benefits or making business or litigation decisions for you. In a simple case, you can just appoint your Agent to manage assets like any real estate you own, personal property or your bank accounts and taxes.

The next stage of creating your document is to have a clear idea of the powers that you wish to bestow upon your chosen Agent.Ĭonsider carefully what financial responsibilities you have as an individual, and how these will affect dependants, business partners or stakeholders. Therefore it’s important to choose carefully. Remember, a Durable Power of Attorney allows your appointed Agent to manage your financial affairs until your death unless you add specific provisions limiting this in your final document. This should be an individual that you trust implicitly and can confidently rely upon to make sensible financial decisions on your behalf.īefore formally appointing your Agent, you should talk with them to discuss the contract that you are to enter into and ensure that they agree to perform your duties according to your wishes. The first step to completing a Power of Attorney Document is to find a suitable person to be your Agent or Attorney-in-Fact. There are a few considerations that you should keep in mind before appointing a Power of Attorney.īefore starting a Durable POA document, individuals are advised to read and understand the following steps: Step 1: Find a Person You Trust Instructions about continuing or withholding life-sustaining treatment if you have an irreversible condition, you cannot care for or make decisions for yourself, and you are expected to die without life-sustaining treatment. Instructions about continuing or withholding life-sustaining treatment if you have a terminal condition (expected to die within six months), or An Advance Directive is strictly limited in scope to:

It allows the Agent(s) or Attorney-in-Fact to act for you if you are incapacitated due to injury, disability, declining health, advanced age, or mental health reasons. The key difference with a DPOA for Healthcare, however, is that it empowers the Agent to make medical decisions for you. This is different from a regular Durable POA or General Power of Attorney, which only grants powers to manage the financial affairs of the individual appointing an Attorney-in-Fact.Ī Durable POA for Healthcare has some similarities to an Advance Directive or Living Will, as it gives details regarding your desires for medical treatment if you are unconscious or incapacitated.

POWER OF ATTORNEY FOR FINANCES HOW TO

A Durable Power of Attorney for Healthcare is an alternative POA document that gives the Agent instructions on how to attend to the Principal’s healthcare needs.

0 kommentar(er)

0 kommentar(er)